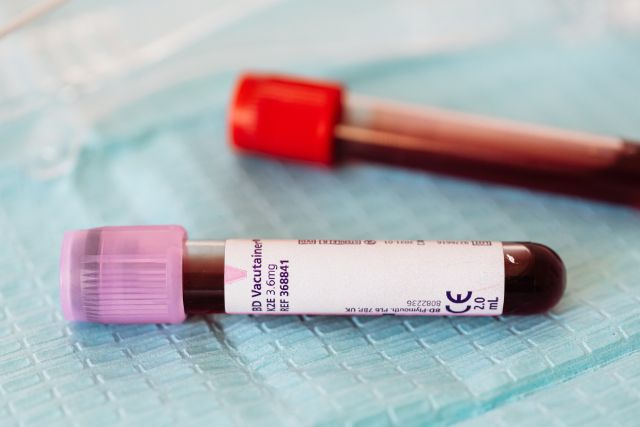

Diagnostics account for 70 percent of all therapeutic decisions. IVD tests comprise medical devices that diagnose, monitor, screen, and assess predispositions to diseases from assays in a test tube or a controlled environment outside the organism, contributing to the available medical information of a patient.

The global IVD market was estimated at $85 bn in 2020. North America is the primary market, and the Asia Pacific is the fasted growing market. Immunoassay is the largest segment, followed by molecular diagnostics. ELISA and CLIA represent the most relevant subsegment in immunoassay, and rapid tests are the fastest-growing subsegment.

PCR is the main subsegment of molecular diagnostics and has been extensively adopted in Covid-19 detection tests. Finally, sequencing and hybridisation are the fastest-growing subsegments, registering double-digit growth in the last couple of years.

From an end-user perspective, laboratories have been the most active due to the tests related to the corona pandemic. However, home care and available point-of-care testing are expected to register the fastest growth.

IVD testing has become vital in the diagnosis of Covid-19, as evident by the considerable number of test kits launched to detect Covid-19 across the globe. These tests have been exempted from regular mandatory food and drug administration (FDA) approvals and granted emergency use authorisation (EUA).

The corona pandemic has had a mixed impact on the IVD industry. During the past two years, all IVD companies concentrated their efforts on Covid-19 test products. While this was a positive milestone from a business point of view, all other tests suffered since they were not considered essential in medical emergencies.

IVD testing has become vital in the diagnosis of Covid-19, as evident by the considerable number of test kits launched to detect Covid-19 across the globe. These tests have been exempted from regular mandatory food and drug administration (FDA) approvals and granted emergency use authorisation (EUA). Some popular test kits for Covid-19 are molecular diagnostic, antibody, and antigen test kits. Molecular diagnostics will open avenues for effective disease prevention and early disease management by providing cost-effective, accurate, and rapid diagnoses of diseases that have been difficult to analyse. Antibody test kits help identify people infected with the virus.

Antigen test kits use quick testing procedures that help determine the presence of active coronavirus infection in patients.

The covid-19 outbreak has also diverted the focus of major market players toward developing rapid detection test kits. For instance, the primary IVD assay used for Covid-19 is based on a real-time reverse transcriptase-polymerase chain reaction (RT-PCR), which takes a few hours to detect the virus.

The overall impact of COVID-19 has been positive for most of the key players in the global in-vitro diagnostics industry. The new COVID-19 tests contribute to offsetting the setback on the rest of the business, mainly caused by lockdowns.

Various macro, healthcare, and IVD-specific trends positively impact the future growth of the In Vitro Diagnostic market.

Macro Trends

Demographic shift and lengthened life expectancy are significant factors influencing growth. People are living longer. The aging of the population, with a steadily increasing life expectancy, will drive the demand for healthcare services, including IVD services. According to the WHO, the global population over 60 years is expected to double from 12% to 22% by 2050. In addition, old-age ailments and health conditions will drive the growth of diagnostics and related aspects. These include cardiovascular, diabetes, and other chronic diseases.

Healthcare Trends

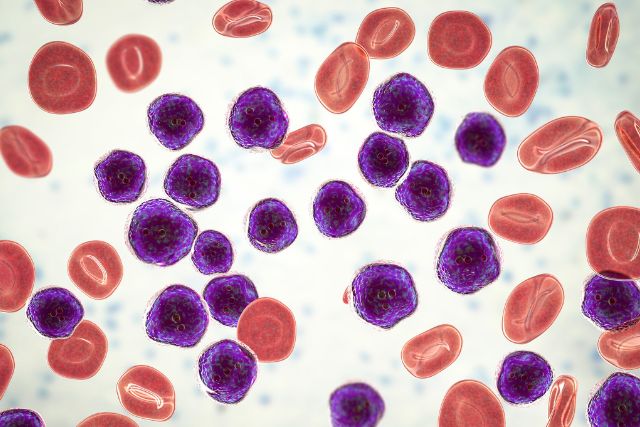

With modernisation, increased movements, and social intermingling, there is an increase in chronic and infectious diseases and detection. Chronic disorders include cancers, diabetes, cardiovascular disorders, obesity, etc. Communicable diseases include diphtheria, Ebola, flu, hepatitis, HIV/AIDS, human papillomavirus, tuberculosis, etc. In addition, outbreaks such as dengue, Zika virus, Swine flu, and Covid-19 are consistently impacting the growth of the infectious disease testing market segment.

A sedentary lifestyle, poor eating habits, smoking, and high alcohol consumption among large swaths of the population are key factors contributing to the increase in these conditions.

The increasing popularity of personalised medicine and prevention and healthcare spending growth drive positive change. As a result, consumers have increasingly embraced the idea of DNA testing in health care. They also want to track their conditions more closely and control when and where they receive diagnostic testing.

IVD Specific Trends

The IVD market has great potential to obstruct the path of rising disease incidences by early diagnosis and treatment monitoring/modification based on diagnostics. Furthermore, the development of epidemiology and the increasing share of health-conscious people are contributing to shifting the emphasis in medicine from reactionary to preventive.

Technological aspects, AI, and the entry of global innovative tech giants into the healthcare segment will also positively impact.

The drivers of future trends in the IVD segment will be – rapid disease identification, ease of use, personalised care, and analytics. Medical device manufacturers are expanding the current base of IVD technologies to pursue new ones. The key technologies are point-of-care (POC), liquid biopsy, molecular diagnostics, artificial intelligence (AI), and the Internet of Things (IoT) used in conjunction with in-vitro diagnostics.

Point-of-Care

Medical testing performed outside the laboratory, or POC testing, provides rapid results. Most POC testing instruments are mobile electronics or molecular collection tools using the lateral flow immunoassay platform.

Incorporating intelligent devices into POC diagnostics has increased this technology’s safety, accuracy, and user-friendliness. Biosensors are newer POC testing technology gaining increased sensitivity as research advances. A commercially available blood glucose monitor is a typical example of biosensors used in POC diagnostics.

Liquid Biopsy

LB detects biomarkers in biological fluids like blood. Patients avoid the pain of tissue or cell removal for lab analysis. This nascent IVD technology is drawing considerable attention.

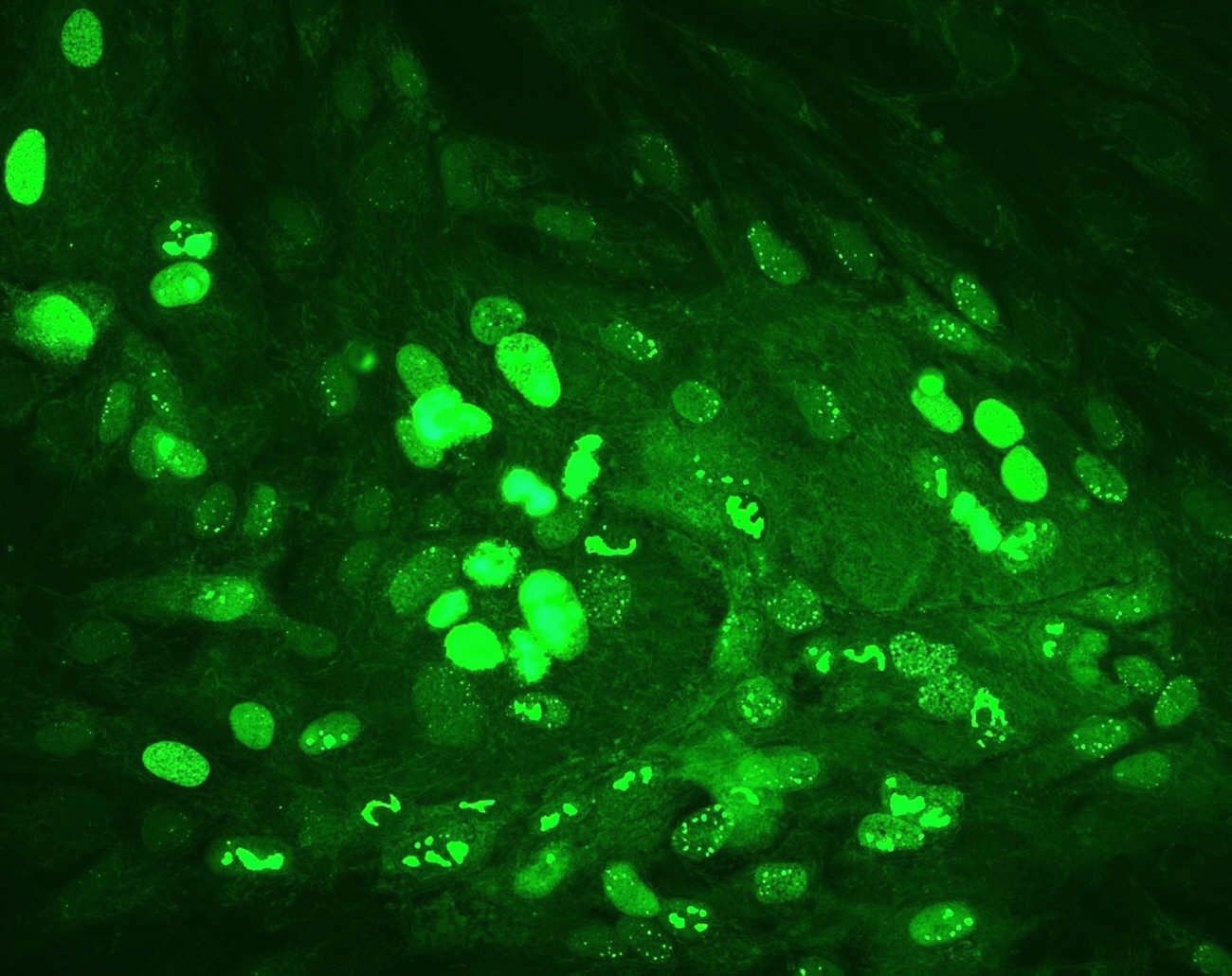

Molecular Diagnostics

With patients’ growing acceptance of more personalised diagnostics and the improved turnaround time for DNA testing results, the technology has moved to the foreground. The wide range of applications for Molecular diagnostics includes: from identifying infectious diseases to oncology to predicting immune function and which drugs work best for a given condition.

AI and IoT

Internet of things (IoT) and Artificial intelligence (AI) have transformed the in-vitro diagnostics industry. AI drives advanced data analytics and reduces errors. Their intelligent devices connect patients to the medical data gathered from in vitro diagnostics tests. IVD technology is likely to grow much faster, driven by all these aspects, and it would be safe to predict a healthier society driven by diagnostics and preventive healthcare.

About author:

The article is authored by Mr. Jatin Mahajan, Managing director at J Mitra and Co. Pvt ltd